Coleman D. Ross

Professional Designation

Examination, Experience, Ethics,

and Education Requirements

Certified Public Accountant

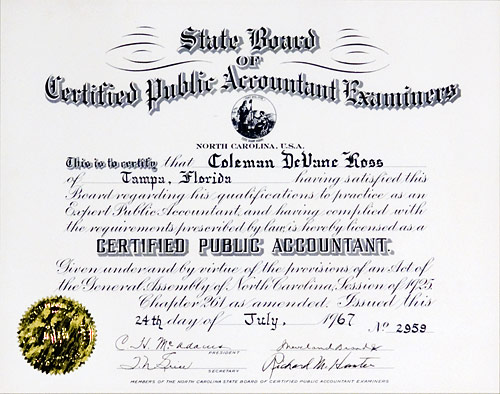

![]() In 1967, I attained my Certified Public Accountant license and

certificate (no. 2959) from the North Carolina State Board of

Certified Public Accountant Examiners, after passing the

AICPA’s Uniform CPA Examination in 1966 and completing two

years of audit experience with Price Waterhouse. In connection with

the annual renewal of my North Carolina license, I complete at least

40 hours of continuing professional education, including

professional ethics study. The topics of the four examinations that

comprised the Uniform CPA Examination that I completed follow:

In 1967, I attained my Certified Public Accountant license and

certificate (no. 2959) from the North Carolina State Board of

Certified Public Accountant Examiners, after passing the

AICPA’s Uniform CPA Examination in 1966 and completing two

years of audit experience with Price Waterhouse. In connection with

the annual renewal of my North Carolina license, I complete at least

40 hours of continuing professional education, including

professional ethics study. The topics of the four examinations that

comprised the Uniform CPA Examination that I completed follow:

- Accounting Theory

- Accounting Practice

- Auditing

- Business Law

In addition to my North Carolina license, I also maintained an

active New York license (no. 071446) in support of my audit

committee role for Syncora's New York domiciled insurer. Also, in

connection with my prior role as a Price Waterhouse audit partner, I

held the following additional CPA licenses during time periods that

those licenses were required because of client responsibilities:

Connecticut (no. 2881; October 1977 – December 1999),

Florida (no. ACR001177; January 1976 – March 1977),

Louisiana (no. B-12542; January 1978 – December 1980),

Massachusetts (no. 15596; April 1993 – June 1994), and

Vermont (no. 001-0898; September 1990 – July 1999).

In addition to my North Carolina license, I also maintained an

active New York license (no. 071446) in support of my audit

committee role for Syncora's New York domiciled insurer. Also, in

connection with my prior role as a Price Waterhouse audit partner, I

held the following additional CPA licenses during time periods that

those licenses were required because of client responsibilities:

Connecticut (no. 2881; October 1977 – December 1999),

Florida (no. ACR001177; January 1976 – March 1977),

Louisiana (no. B-12542; January 1978 – December 1980),

Massachusetts (no. 15596; April 1993 – June 1994), and

Vermont (no. 001-0898; September 1990 – July 1999).

(back to the Professional Designations main page)

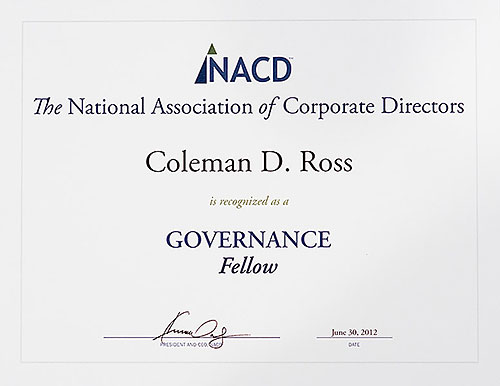

NACD Directorship Certified

Board Leadership Fellow

Board Leadership Fellow

Governance Fellow

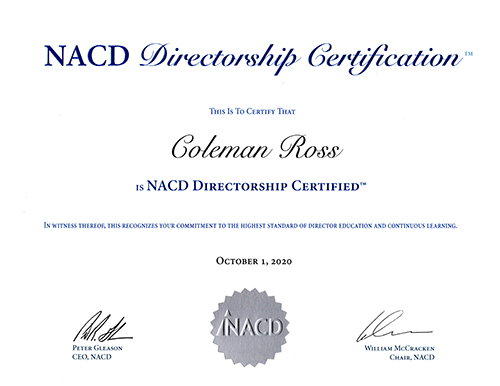

![]() The NACD has been committed to equipping its members with the

knowledge and skills required to serve in the boardroom. In late

2019, the NACD launched the first-ever US-based certification

program for public company directors: NACD Directorship

Certification. Directors who successfully complete the program

become NACD Directorship Certified.

The NACD has been committed to equipping its members with the

knowledge and skills required to serve in the boardroom. In late

2019, the NACD launched the first-ever US-based certification

program for public company directors: NACD Directorship

Certification. Directors who successfully complete the program

become NACD Directorship Certified.

The NACD believes that certification will elevate the directorship profession by:

- setting the standard for continuing education in the profession;

- ensuring that directors will have a baseline understanding of the requisite knowledge and skills required to be a board member;

- enabling stakeholders to view corporate directors as trusted stewards of long-term value creation, ultimately helping to bolster investor trust and public confidence in corporations; and

- enhancing the talent pool for public boards by recognizing individuals who have committed to continuous learning.

Components of this program include a three-day course covering the fundamentals of board service; a study guide to help in preparation for the examination and provides additional information and resources to augment learning beyond the examination; and an examination covering the key areas of the knowledge, skills, and abilities needed to serve on a board.

The study guide and the examination comprise the following areas of competency:

- The Role of the Board: fiduciary duties, corporate governance requirements, board processes and cultures, and shareholder engagement.

- The Board’s Standing Committees: audit committee, compensation committee, and nominating and governance committee.

- The Board’s Duty to Select the Chief Executive Officer: CEO succession planning, CEO evaluation, and executive compensation.

- Traditional Areas of Board Oversight: oversight of risk, strategy, financial performance, mergers and acquisitions, ethics and compliance, talent, and crises.

- Emerging Areas of Board Oversight: oversight of culture; cyber risk oversight; and environmental, social, and governance issues.

I completed the NACD Directorship Certification examination in June 2020 and became NACD Directorship Certified. To maintain this designation, I am required to complete 32 hours of NACD-approved continuing education over a two-year period.

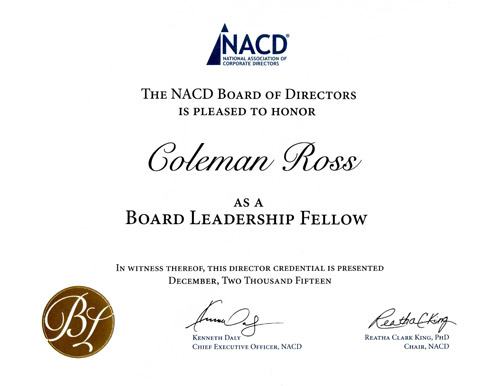

In support of my roles as an independent director, I completed the

National Association of Corporate Directors' two-day Advanced

Director Professionalism course in June 2015. The NACD is a

membership organization dedicated to serving the corporate

governance needs of corporate directors and boards. To attain its

Board Leadership Fellow designation, I was further required to

complete another ten hours of NACD-approved continuing education,

which I also did in July 2015. To maintain this designation, I am

required to annually complete ten hours of NACD-approved continuing

education. The organization's advanced professionalism course that I

completed covered the following curriculum topics:

In support of my roles as an independent director, I completed the

National Association of Corporate Directors' two-day Advanced

Director Professionalism course in June 2015. The NACD is a

membership organization dedicated to serving the corporate

governance needs of corporate directors and boards. To attain its

Board Leadership Fellow designation, I was further required to

complete another ten hours of NACD-approved continuing education,

which I also did in July 2015. To maintain this designation, I am

required to annually complete ten hours of NACD-approved continuing

education. The organization's advanced professionalism course that I

completed covered the following curriculum topics:

- NACD's Key Agreed Principles to strengthen corporate governance

- A Price Worth Paying: case study on governance crises facing boards

- Dynamic or Dysfunctional: having the right boardroom culture and dynamics in place to allow the board to function at its highest level

- A Year in the Life of Your Board: how to make the most of one's time with one's fellow directors

- Audit Committee: small group peer exchange

- Winning with mergers and acquisitions

- Small-cap governance hot topics

- Transitioning from private to public company governance

- Cyber risk

- The future of shareholder activism

- Strategy from a board perspective

- Lead director training

Previously, in support of my role as an independent director, I

completed the NACD's two-day Director Professionalism course and

earned the Governance Fellow designation in April 2012. I had

completed a previous version of a similar program and received the

Certificate of Director Education in June 2008 (see

Education page). To maintain this

designation, I am required to annually complete four hours of

NACD-approved continuing education. The organization's

professionalism course that I completed covered the following

curriculum topics:

Previously, in support of my role as an independent director, I

completed the NACD's two-day Director Professionalism course and

earned the Governance Fellow designation in April 2012. I had

completed a previous version of a similar program and received the

Certificate of Director Education in June 2008 (see

Education page). To maintain this

designation, I am required to annually complete four hours of

NACD-approved continuing education. The organization's

professionalism course that I completed covered the following

curriculum topics:

- Board excellence: responsibilities in the current governance environment

- Fiduciary duties of corporate boards

- Strategy from a board perspective

- New Era Faces the Future: case study on newly-appointed board member addressing her concerns

- Utilizing financial statements to drive value: a guide for directors

- Nonprofit governance: notable trends and best practice

- Audit Committee: effectiveness in the new environment

- The Nominating and Governance Committee: new challenges and opportunities in board composition

- Board / C-Suite relations

- Adding value through the Compensation Committee

(back to the Professional Designations main page)

Audit Committee Financial Expert

In connection with my audit committee role on the Syncora Holdings Ltd. board of directors, I am designated as an Audit Committee Financial Expert. The term is defined by the U.S. Securities and Exchange Commission (Regulation S-K, Item 401(h)), and each public company registrant is required to have at least one Audit Committee Financial Expert on its audit committee.

The attributes that the SEC requires of me, as an Audit Committee Financial Expert, follow:

- An understanding of generally accepted accounting principles and financial statements;

- The ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves;

- Experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of issues that are generally comparable to the breadth and complexity of issues expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities;

- An understanding of internal controls and procedures for financial reporting; and

- An understanding of audit committee functions.

Also as required by the SEC, these attributes would be acquired through any one or more of the following:

- Education and experience as a principal financial officer, principal accounting officer, controller, public accountant, or auditor or experience in one or more positions that involve performance of similar functions;

- Experience actively supervising a principal financial officer, principal accounting officer, controller, public accountant, auditor, or person performing similar functions;

- Experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing, or evaluation of financial statements; or

- Other relevant experience.

I acquired and continue to have these attributes that are relevant to the insurance and financial services industries through:

- My public accounting auditor experience for 34 years, including 22 years as an audit partner;

- My subsequent public company experience for 3-1/2 years as the chief financial officer for two New York Stock Exchange-listed companies;

- My subsequent audit committee experience for over 15 years as the committee chairman for four separate companies;

- My additional experience as a member of the AICPA's senior accounting and financial reporting technical committee and on other AICPA committees and task forces dealing with technical accounting and auditing issues;

- My undergraduate education in accounting; and

- My graduate level education in both economics and financial services.

In addition to SEC audit committee requirements, I meet audit committee requirements of the New York Stock Exchange Listed Manuel (303A.01(a)) by having accounting or related financial management expertise and being financially literate.

In connection with my audit committee role on the Omega Insurance

Holdings Limited board of directors and its listing on the London

Stock Exchange, I was designated the audit committee’s member

having:

In connection with my audit committee role on the Omega Insurance

Holdings Limited board of directors and its listing on the London

Stock Exchange, I was designated the audit committee’s member

having:

- recent and relevant financial experience;

- competence in accounting or auditing, or both; and

- a professional qualification from one of the professional accounting bodies.

(back to the Professional Designations main page)

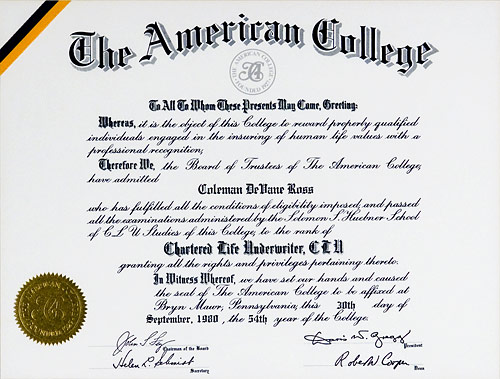

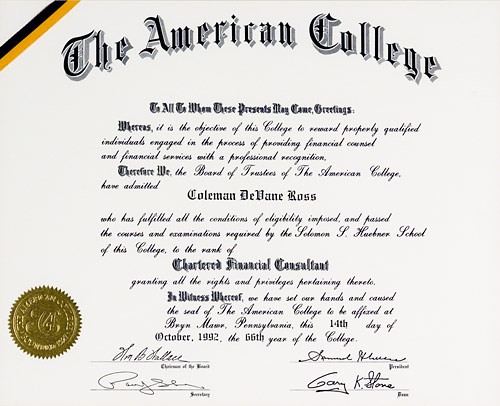

Chartered Life Underwriter

Chartered Life Underwriter

Chartered Financial Consultant

Chartered

Advisor in Philanthropy

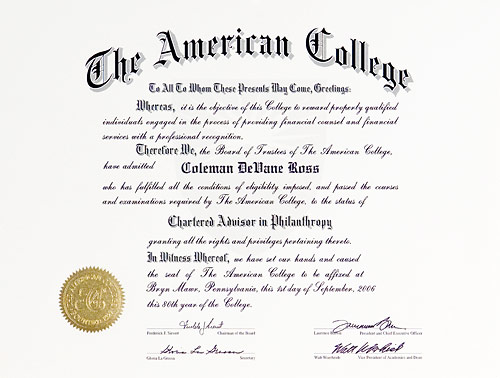

The Chartered Life Underwriter, as well as the Chartered Financial

Consultant, designations are offered by the Solomon S. Huebner

School of The American College to candidates with relevant

experience who pass required examinations and subscribe to the

school’s ethical standards and ongoing continuing education

requirements. I attained my CLU designation in 1980, while serving

as the audit partner for both Connecticut General and Phoenix Mutual

Life, and my ChFC designation in 1992, while serving as the national

leader of our firm’s insurance practice and as the audit

partner for State Mutual Life. The requirements of the ChFC

designation required me to complete three examinations beyond the

CLU designation.

The Chartered Life Underwriter, as well as the Chartered Financial

Consultant, designations are offered by the Solomon S. Huebner

School of The American College to candidates with relevant

experience who pass required examinations and subscribe to the

school’s ethical standards and ongoing continuing education

requirements. I attained my CLU designation in 1980, while serving

as the audit partner for both Connecticut General and Phoenix Mutual

Life, and my ChFC designation in 1992, while serving as the national

leader of our firm’s insurance practice and as the audit

partner for State Mutual Life. The requirements of the ChFC

designation required me to complete three examinations beyond the

CLU designation.

![]()

While enrolled in The American College’s MSFS program at its Richard D. Irwin Graduate School (see Education page), I also completed the school’s Chartered Advisor in Philanthropy designation. The designation required me to complete three charitable giving courses (nine semester hours) and meet experience and ethics requirements. I started the program in 2003, both as an adjunct to my MSFS studies and to support my fundraising efforts on behalf of the Boy Scouts of America. I completed the last examination in July 2006 and received the designation in September 2006.

The subjects of the sixteen examinations that I completed follow:

Chartered Life Underwriter

- Economic Security and Individual Life Insurance

- Income Taxation

- The Financial System in the Economy

- Individual Life Insurance

- Life Insurance Law

- Group Benefits

- Planning for Retirement Needs

- Investments

- Fundamentals of Estate Planning

- Planning for Business Owners and Professionals

Chartered Financial Consultant

- Fundamentals of Financial Planning

- Income Taxation

- The Financial System in the Economy

- Individual Life Insurance

- Planning for Retirement Needs

- Investments

- Wealth Accumulation Planning

- Fundamentals of Estate Planning

- Planning for Business Owners and Professionals

- Financial Planning Applications

Chartered Advisor in Philanthropy

- Charitable Giving

- Charitable Giving Applications

-

Charitable Giving: Managing the Tools,

the Applications, and the Relationships

(back to the Professional Designations main page)

Fellow, Life Management Institute

Fellow, Life Management Institute

Associate in Insurance Accounting and Finance

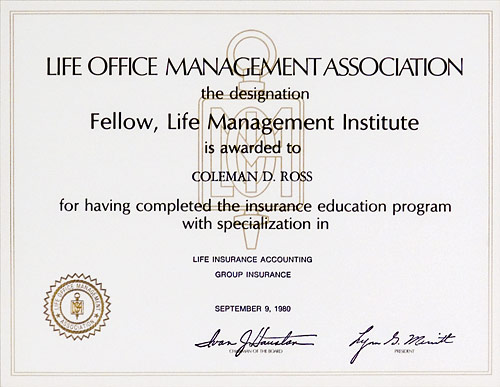

![]() The Fellow, Life Management Institute designation is offered by

the Life Office Management Association to candidates who pass

required examinations in general courses and a specialization

course. I attained my FLMI designation in 1980 while serving as the

engagement partner for Connecticut General Life and Phoenix Mutual

Life, after having started the program in 1977. In addition to the

requirement for a specialization course, I also completed

examinations in two additional specialization courses in 1980 and

1989.

The Fellow, Life Management Institute designation is offered by

the Life Office Management Association to candidates who pass

required examinations in general courses and a specialization

course. I attained my FLMI designation in 1980 while serving as the

engagement partner for Connecticut General Life and Phoenix Mutual

Life, after having started the program in 1977. In addition to the

requirement for a specialization course, I also completed

examinations in two additional specialization courses in 1980 and

1989.

![]()

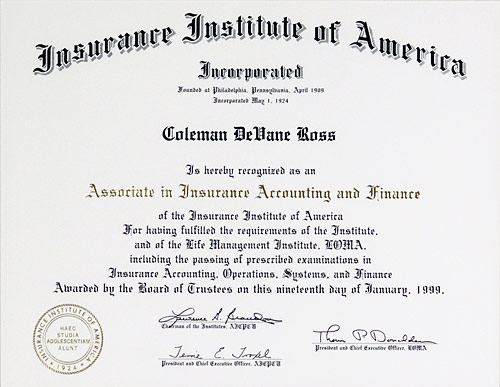

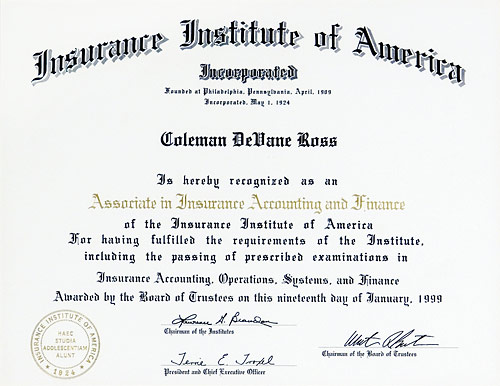

![]() I also attained the Associate in Insurance Accounting and Finance

designation offered by LOMA (together with the Insurance Institute

of America) in 1998 while serving as the engagement partner for

Phoenix Home Life.

I also attained the Associate in Insurance Accounting and Finance

designation offered by LOMA (together with the Insurance Institute

of America) in 1998 while serving as the engagement partner for

Phoenix Home Life.

The subjects of the 14 examinations that I completed follow:

Fellow, Life Management Institute general courses

- Principles of Insurance: Life, Health, and Annuities

- Life and Health Insurance Company Operations

- Legal Aspects of Life and Health Insurance

- Management Principles and Practices

- Information Management in Insurance Companies

- Economics and Investments

- Accounting in Life and Health Insurance Companies

- Mathematics of Life and Health Insurance

Fellow, Life Management Institute specialization courses

- Life Insurance Accounting

- Group Insurance

- Financial Management

Associate in Insurance Accounting and Finance

- Statutory Accounting for Life and Health Insurers

- Insurance Information Systems

- Insurance Company Finance

- Life and Health Insurance Company Operations

- Mathematics of Life and Health Insurance

(back to the Professional Designations main page)

Chartered Property Casualty Underwriter

Associate in Reinsurance

Associate in Insurance Accounting and Finance

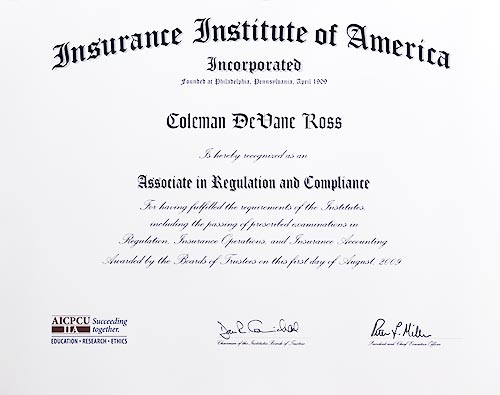

Associate in Regulation and Compliance

Associate in Regulation and Compliance

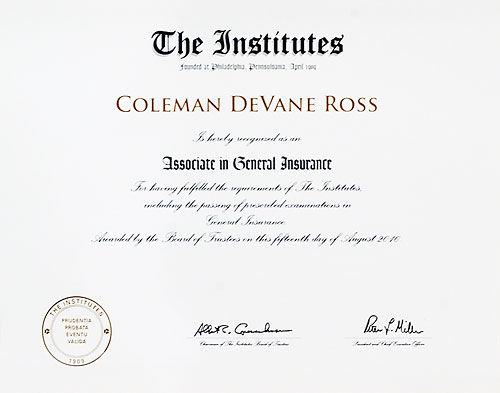

Associate in General Insurance

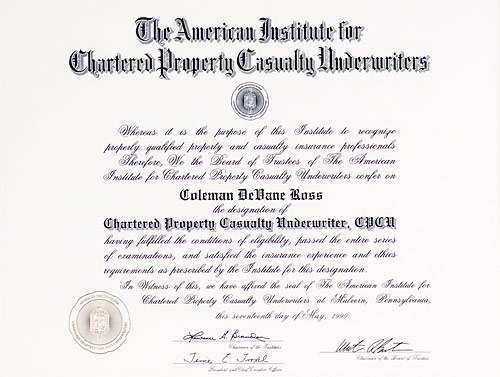

The Chartered Property Casualty Underwriter designation is offered

by The American Institute of Chartered Property Casualty

Underwriters to candidates with three years or relevant experience

who pass required examinations and subscribe to the AICPCU’s

ethical standards. I attained my CPCU designation in 1999 while

serving as the audit partner for XL Capital, a large Bermuda-based

property-casualty insurer, and Trenwick Group, a property-casualty

reinsurer, after having started the program several years earlier.

The Chartered Property Casualty Underwriter designation is offered

by The American Institute of Chartered Property Casualty

Underwriters to candidates with three years or relevant experience

who pass required examinations and subscribe to the AICPCU’s

ethical standards. I attained my CPCU designation in 1999 while

serving as the audit partner for XL Capital, a large Bermuda-based

property-casualty insurer, and Trenwick Group, a property-casualty

reinsurer, after having started the program several years earlier.

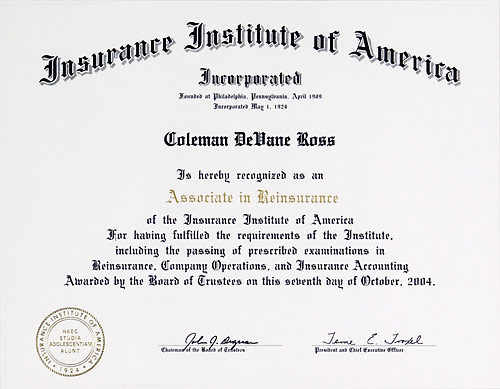

In addition to the CPCU designation, I also attained the Associate

in Reinsurance, Associate in Insurance Accounting and Finance,

Associate in Regulation and Compliance, and Associate in General

Insurance designations from the Insurance Institute of America,

which is a companion organization to the AICPCU. These are offered

to candidates who pass examinations in four, four, three, and four

respectively, property and liability insurance-related courses in

each program (twelve examinations in total and ten examinations

beyond the CPCU requirements). I attained the ARe designation in

2004 during my “second” retirement and after years of

service on the AICPA’s Reinsurance Auditing and Accounting

Task Force and working with and for reinsurers. I also attained the

ARC designation during my "second" retirement, as Syncora

Guarantee was facing regulatory oversight in 2009 during its

financial difficulties. I had previously attained the AIAF

designation in 1998 while serving as the engagement partner for XL

Capital and Trenwick Group. I attained my AINS designation in 2010.

In addition to the CPCU designation, I also attained the Associate

in Reinsurance, Associate in Insurance Accounting and Finance,

Associate in Regulation and Compliance, and Associate in General

Insurance designations from the Insurance Institute of America,

which is a companion organization to the AICPCU. These are offered

to candidates who pass examinations in four, four, three, and four

respectively, property and liability insurance-related courses in

each program (twelve examinations in total and ten examinations

beyond the CPCU requirements). I attained the ARe designation in

2004 during my “second” retirement and after years of

service on the AICPA’s Reinsurance Auditing and Accounting

Task Force and working with and for reinsurers. I also attained the

ARC designation during my "second" retirement, as Syncora

Guarantee was facing regulatory oversight in 2009 during its

financial difficulties. I had previously attained the AIAF

designation in 1998 while serving as the engagement partner for XL

Capital and Trenwick Group. I attained my AINS designation in 2010.

In conjunction with two of the above certificate programs, I also earned the IIA's Certificate in General Insurance in 1998 and Certificate in Regulatory Compliance in 2009.

The subjects of the 20 examinations that I completed follow:

Chartered Property Casualty Underwriter

- Ethics, Insurance Perspectives, and Insurance Contract Analysis

- Personal Property and Liability Insurance and Risk Management

- Commercial Property Insurance and Risk Management

- Commercial Liability Insurance and Risk Management

- Insurance Operations

- Legal Environment of Insurance

- Management

- Accounting and Finance

- Economics

- Insurance Issues and Ethics

Associate in Reinsurance

- Principles of Reinsurance

- Reinsurance Practices

- Accounting and Finance

- Insurance Operations

Associate in Insurance Accounting and Finance

- Statutory Accounting for Property and Liability Insurers

- Insurance Operations

- Insurance Information Systems

- Insurance Company Finance

Associate in Regulation and Compliance and

Certificate in Regulatory Compliance

- Insurance Regulation

- Statutory Accounting for Property and Liability Insurers

- Insurance Operations

Associate in General Insurance and

Certificate in General Insurance

- General Principles of Insurance

- Personal Insurance

- Commercial Insurance

- Ethical Guidelines for Insurance Professionals

(back to the Professional Designations main page)

Fellow of the Chartered Insurance Institute

Fellow of the Chartered Insurance Institute

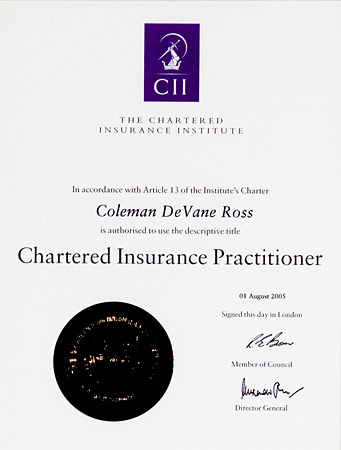

Chartered Insurance Practitioner

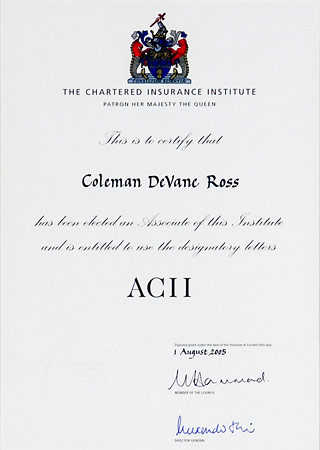

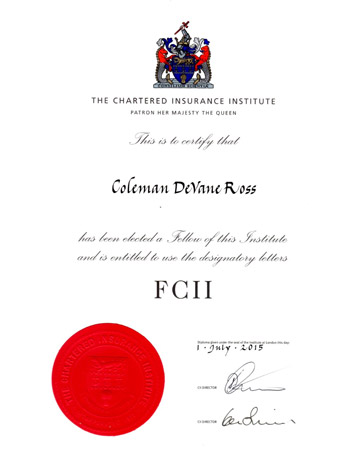

Concurrent with earning the Chartered Insurance Institute's

Advanced Diploma in Insurance in 2005 (see

Education page), I also received the

Associate in the Chartered Insurance Institute (ACII) as well as the

Chartered Insurance Practitioner designations. These two

designations are held by individuals who have completed the Advanced

Diploma program and who meet educational, experience, and ethical

requirements.

Concurrent with earning the Chartered Insurance Institute's

Advanced Diploma in Insurance in 2005 (see

Education page), I also received the

Associate in the Chartered Insurance Institute (ACII) as well as the

Chartered Insurance Practitioner designations. These two

designations are held by individuals who have completed the Advanced

Diploma program and who meet educational, experience, and ethical

requirements.

In 2015, I completed the final steps beyond the ACII designation, becoming a Fellow of the Chartered Insurance Institute. The Fellowship designation is regarded by the CII as the premier qualification for those working in the insurance industry. The most significant requirements in my Fellowship process were recording a major qualification achievement (in my case, a graduate degree), completing a business ethics programme of case studies involving insurance ethical dilemmas, and undertaking continuing education specific to my role in the insurance industry.

(back to the Professional Designations main page)

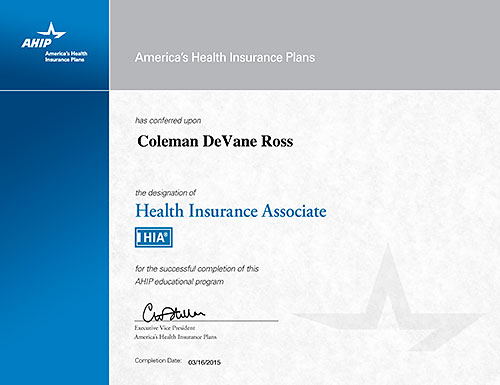

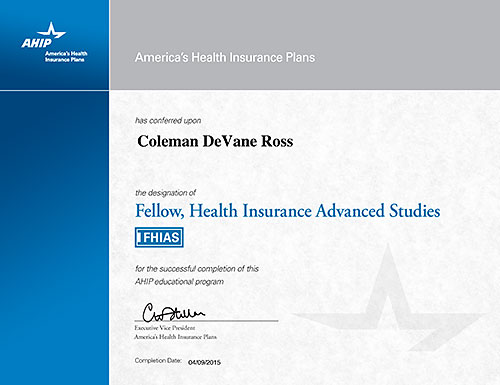

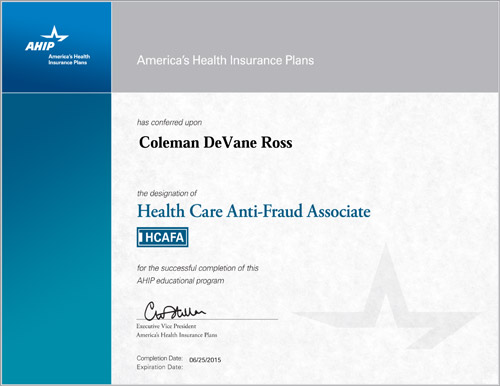

Health Insurance Associate

Fellow, Health Insurance Advanced Studies

Fellow, Health Insurance Advanced Studies

Professional, Health Insurance Advanced Studies

Health Care Anti-Fraud Associate

The Health Insurance Associate; Fellow, Health Insurance Advanced Studies; and Health Care Anti-Fraud Associate programs are offered by America's Health Insurance Plans, a national association representing member companies providing health insurance coverage to groups and individuals. I attained the HIA, FHIAS, and HCAFA designations in 2015 in the process of refreshing and expanding my health insurance knowledge, based primarily on changes created by the Affordable Care Act, and to support my directorship role with Pan-American Life Insurance Group, a major health insurance underwriter. The three programs required the completion of nine examinations and two fraud-related webinars. In the process of attaining the HIA designation, I also attained AHIP's Professional, Health Insurance Advanced Studies designation for passing one of the examinations. The subjects of the nine examinations and two webinars that I completed follow:

Health Insurance Associate

- Basics of Health Insurance

- Health Insurance Company Operations

- Supplemental Health Insurance

- Health Insurance Advanced Studies, Part A

- Disability Insurance (elective)

- Introduction to Health Insurance Fraud (elective)

Fellow, Health Insurance Advanced Studies and

Professional,

Health Insurance Advanced Studies

- Health Insurance Advanced Studies, Part A

- Health Insurance Advanced Studies, Part B

- Understanding Medicare (elective)

Health Care Anti-Fraud Associate

- Introduction to Health Insurance Fraud

- Health Insurance Fraud: Key Products

- New Areas of Legal Risk under the Affordable Care Act, the False Claims Act, and Related Laws (webinar elective)

- Medical Identity Theft: The Stakes and Consequences for Health Plans (webinar elective)

(back to the Professional Designations main page)

Chartered Financial Analyst Program

The Chartered Financial Analyst program is offered by the CFA

Institute (formerly the Association for Investment Management and

Research, or AIMR) to candidates who meet experience, ethical, and

educational requirements. I enrolled in the CFA program because I

thought it would be difficult and challenging and I haven’t

been disappointed. I have completed two of the three CFA

examinations and am not certain if I will work to complete the

program, given my current focus as an independent director. The

designation program requires the completion of three examinations,

offered annually, covering these topics:

The Chartered Financial Analyst program is offered by the CFA

Institute (formerly the Association for Investment Management and

Research, or AIMR) to candidates who meet experience, ethical, and

educational requirements. I enrolled in the CFA program because I

thought it would be difficult and challenging and I haven’t

been disappointed. I have completed two of the three CFA

examinations and am not certain if I will work to complete the

program, given my current focus as an independent director. The

designation program requires the completion of three examinations,

offered annually, covering these topics:

- Portfolio Management

- Portfolio Performance Presentation

- Analysis of Equity, Debt, Derivative, and Alternative Investments

- Corporate Finance

- Financial Statement Analysis

- Economics

- Quantitative Methods

- Ethical and Professional Standards

(back to the Professional Designations main page)

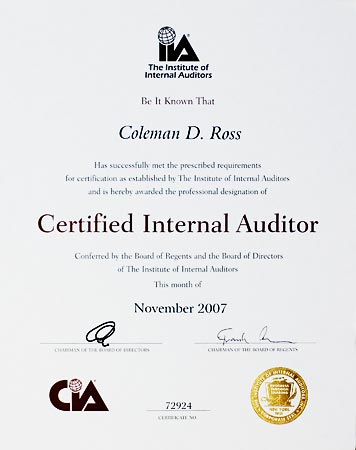

Certified Internal Auditor

Certified Internal Auditor

Certified Financial Services Auditor

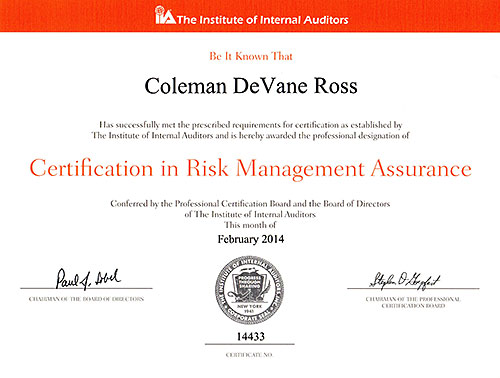

Certification in Risk Management Assurance

The Certified Internal Auditor program is offered by The Institute

of Internal Auditors to candidates who meet experience, educational,

and ethical standards. I completed the program in 2007, having

started it during my "second" retirement to support my

service as an independent director and financial expert serving on

audit committees. The four examinations in the CIA program cover

these topics:

The Certified Internal Auditor program is offered by The Institute

of Internal Auditors to candidates who meet experience, educational,

and ethical standards. I completed the program in 2007, having

started it during my "second" retirement to support my

service as an independent director and financial expert serving on

audit committees. The four examinations in the CIA program cover

these topics:

- Conducting the Internal Audit Engagement

- The Internal Audit Activity’s Role in Governance, Risk, and Control

- Business Analysis and Information Technology

- Business Management Skills

I also attained the Certified Financial Services Auditor

designation from the IIA in 2002. The institute requires qualified

CFSA candidates complete an examination covering audit practices and

methodologies for banking, insurance, and securities industries.

I also attained the Certified Financial Services Auditor

designation from the IIA in 2002. The institute requires qualified

CFSA candidates complete an examination covering audit practices and

methodologies for banking, insurance, and securities industries.

In 2014 I also attained the Certification in Risk Management

Assurance from the IIA after passing an examination covering

organizational governance related to risk management, principles of

risk management processes, and assurance and consulting role of the

internal auditor and having previously passed an examination on

conducting the internal audit engagement.

In 2014 I also attained the Certification in Risk Management

Assurance from the IIA after passing an examination covering

organizational governance related to risk management, principles of

risk management processes, and assurance and consulting role of the

internal auditor and having previously passed an examination on

conducting the internal audit engagement.

My CIA, CFSA, and CRMA designations are inactive as I am not currently a member of The Institute of Internal Auditors.

(back to the Professional Designations main page)

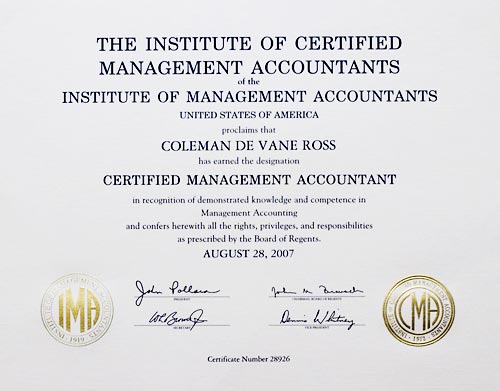

Certified Management Accountant

Certified Management Accountant

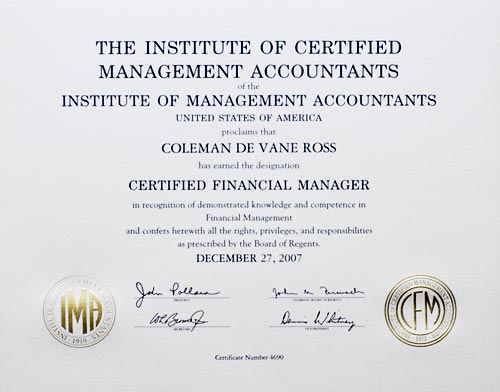

Certified Financial Manager

The Certified Management Accountant program is offered by the

Institute of Management Accountants (formerly the National

Association of Accountants), as was a companion Certified Financial

Manager program, prior to its discontinuance. Each of the

designations required the completion of four examinations (five

examinations in total). I started these programs during my

‘second’ retirement to support my service as an

independent director, and I completed the last examinations in each

program in 2007. The five examinations required in total for these

designation programs cover these subjects:

The Certified Management Accountant program is offered by the

Institute of Management Accountants (formerly the National

Association of Accountants), as was a companion Certified Financial

Manager program, prior to its discontinuance. Each of the

designations required the completion of four examinations (five

examinations in total). I started these programs during my

‘second’ retirement to support my service as an

independent director, and I completed the last examinations in each

program in 2007. The five examinations required in total for these

designation programs cover these subjects:

Certified Management Accountant

- Economics, Finance, and Management

- Financial Accounting and Reporting

- Management Reporting, Analysis, and Behavioral Issues

- Decision Analysis, Information Systems, and Management Controls

Certified Financial Manager

- Economics, Finance, and Management

- Corporate Financial Management

- Management Reporting, Analysis, and Behavioral Issues

-

Decision Analysis, Information Systems, and Management Controls

My CMA and CFM designations are inactive as I am not currently a member of the Institute of Management Accountants.

(back to the Professional Designations main page)

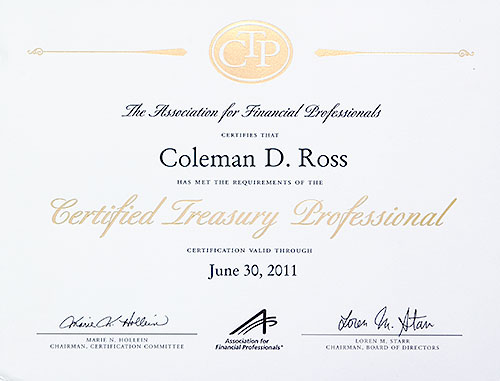

Certified Treasury Professional

The Certified Treasury Professional program is offered by the

Association for Financial Professionals (formerly the Treasury

Management Association) to candidates who meet experience, ethical,

and education requirements. Recipients of the designation are

required to complete at least 36 hours of qualifying continuing

professional education every three years. I enrolled in the program

to support my service as an independent director and financial

expert serving on audit committees, and I completed the program's

examination in 2008. The examination covered the following topics:

The Certified Treasury Professional program is offered by the

Association for Financial Professionals (formerly the Treasury

Management Association) to candidates who meet experience, ethical,

and education requirements. Recipients of the designation are

required to complete at least 36 hours of qualifying continuing

professional education every three years. I enrolled in the program

to support my service as an independent director and financial

expert serving on audit committees, and I completed the program's

examination in 2008. The examination covered the following topics:

- Background and Environment of Treasury Management (The Role of Treasury Management; Treasury Organizational Structure; and Financial Environment)

- General Financial Analysis (Financial Accounting and Financial Planning and Analysis)

- Liquidity Management (Working Capital Management; Working Capital Tools; Payment Systems; Cash Management; and Short-term Investing and Financing Decisions)

- Treasury Technology (Treasury Management Systems and Electronic Commerce)

- Long-term Finance (Sources of Capital and Capital Structure and Dividend Policy)

- Global Finance (Global Treasury Environment and Global Treasury Organization and Liquidity Management)

- Other Areas of Treasury Management (Financial Risk Management; Operational and Insurance Risk Management; Corporate Governance and Ethics; Retirement Fund Management; and Relationship Management)

My CTP designation is inactive as I am not currently a member of the Association for Financial Professionals.

(back to the Professional Designations main page)

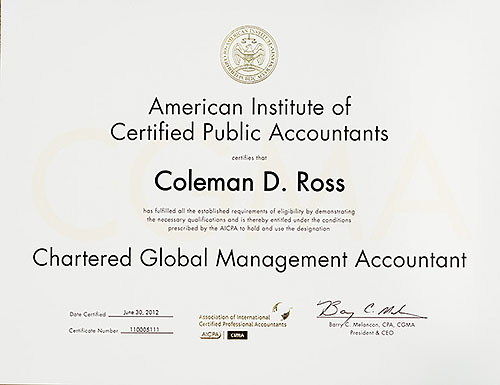

Chartered Global Management Accountant

Chartered Global Management Accountant

![]() The Chartered Management Accountant designation is granted by the

Association of International Certified Professional Accountants, a

joint venture between the American Institute of CPAs and the

UK-based Chartered Institute of Management Accountants. The

designation was awarded to me and other AICPA members who were CPAs

and met management accounting experience requirements.

The Chartered Management Accountant designation is granted by the

Association of International Certified Professional Accountants, a

joint venture between the American Institute of CPAs and the

UK-based Chartered Institute of Management Accountants. The

designation was awarded to me and other AICPA members who were CPAs

and met management accounting experience requirements.

(back to the Professional Designations main page)

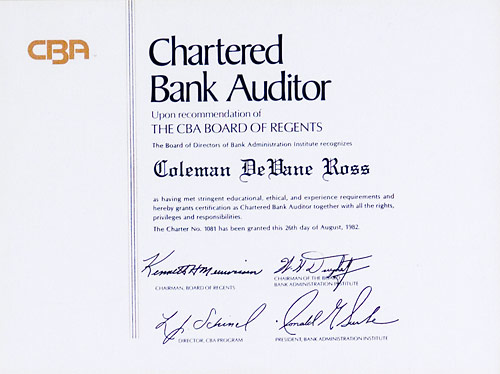

Certified Bank Auditor

The Certified Bank Auditor designation is offered by the Bank

Administration Institute to candidates who meet educational,

experience, and ethical requirements. I attained my CBA designation

(which was then the Chartered Bank Auditor designation) in 1982

while serving as the audit partner for Hartford National (which was

subsequently renamed Shawmut National and now is part of Bank of

America) and beginning my study at The School of Banking at

Louisiana State University. To maintain the active status of my CBA

designation, I completed at least 60 hours of qualifying continuing

professional education during a two-year period and also complied

with the CBA Code of Ethics. I did not renew my CBA certification in

2008 as my current activities as an independent director do not

involve banking.

The Certified Bank Auditor designation is offered by the Bank

Administration Institute to candidates who meet educational,

experience, and ethical requirements. I attained my CBA designation

(which was then the Chartered Bank Auditor designation) in 1982

while serving as the audit partner for Hartford National (which was

subsequently renamed Shawmut National and now is part of Bank of

America) and beginning my study at The School of Banking at

Louisiana State University. To maintain the active status of my CBA

designation, I completed at least 60 hours of qualifying continuing

professional education during a two-year period and also complied

with the CBA Code of Ethics. I did not renew my CBA certification in

2008 as my current activities as an independent director do not

involve banking.

The four examinations that I completed to receive my CBA designation covered the following topics:

- Accounting

- Auditing Principles and Practices

- Banking Law and Regulation

- General Business

(back to the Professional Designations main page)

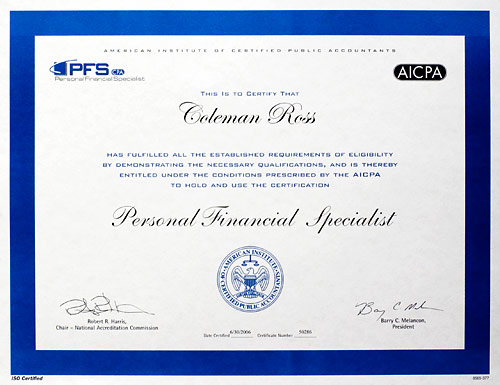

Personal Financial Specialist

![]() In addition to earning the Certified Public Accountant

designation, I also attained the AICPA’s Personal Financial

Specialist credential in 2006. This credential is earned by

institute members who have the requisite years of experience and

education in financial planning and have passed a comprehensive

financial planning examination. I did not renew my PFS certification

in 2008 as my role as an independent director does not involve

financial planning.

In addition to earning the Certified Public Accountant

designation, I also attained the AICPA’s Personal Financial

Specialist credential in 2006. This credential is earned by

institute members who have the requisite years of experience and

education in financial planning and have passed a comprehensive

financial planning examination. I did not renew my PFS certification

in 2008 as my role as an independent director does not involve

financial planning.

(back to the Professional Designations main page)